What is the HS Code of Sanitary Ware?

When you are importing sanitary ware from China, it’s important to know what are the HS Codes / Tariff Codes. Why? It will ensure that the cargo/commodity information you submit to the customs and relevant departments is true, accurate, and complete.

Table of Contents

What is HS Code / HTS Code?

The HS code is known as customs code or commodity code. HS is short for the Harmonized Coding System. Its full name is International Convention for Harmonized Commodity Description and Coding System, abbreviated as Harmonized System (HS).

This is a commodity classification and coding system developed by the World Customs Organization for customs, statistics, import and export management and common use with all parties involved in international trade. It is applicable to tax regulations, statistics, production, transportation, trade control, inspection and quarantine, etc. At present, more than 98% of global trade volume uses this catalog, which has become a standard language for international trade.

It can be understood that commodity codes are an important basis for customs and commodity inspections to classify imported and exported goods. If they cannot be provided, import and export goods cannot be declared for inspection and customs declaration, and import and export procedures cannot be handled normally.

The Effect of HS Code

1). Customs Supervision

The customs needs to to supervise the imported and exported commodities by the HS codes.

2). Commodity Inspection

Through the HS code, relevant inspections (statutory inspection and quarantine and its category) can be carried out for the commodities that need to be inspected.

3). Tax Collection

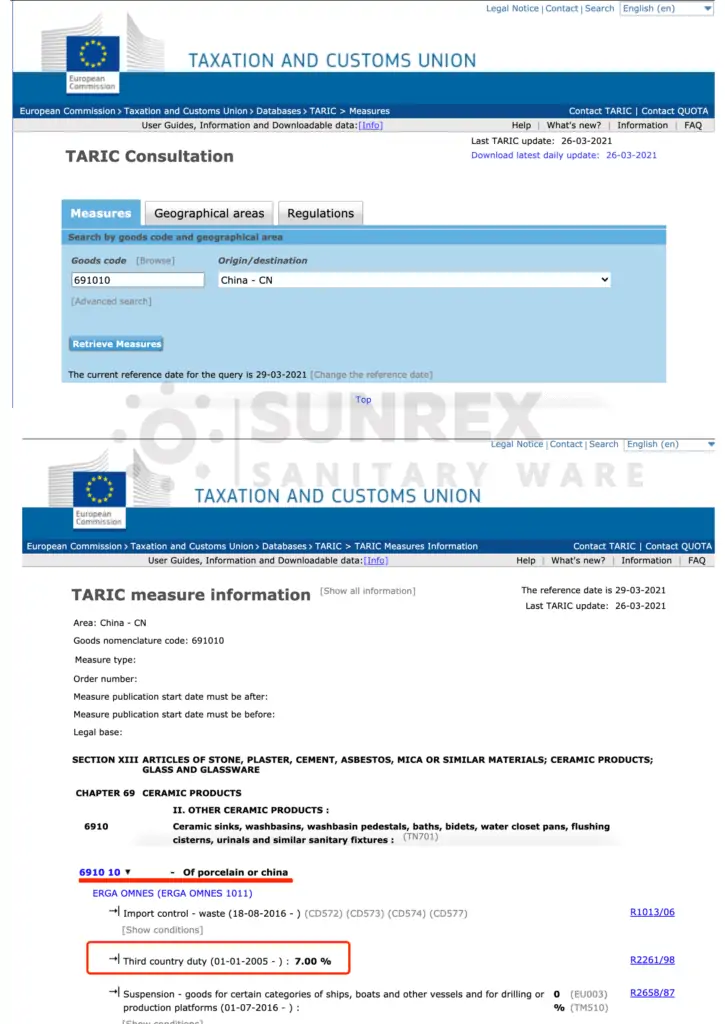

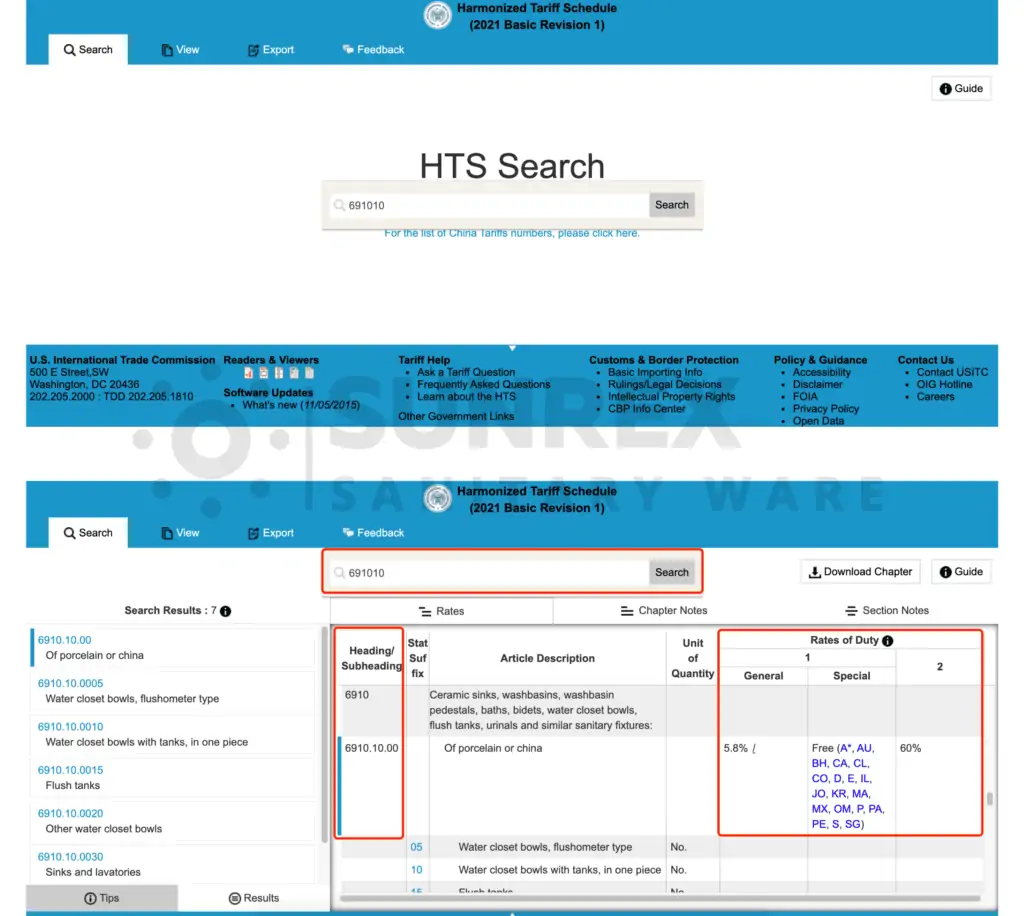

The tax bureau can collect taxes (or tariffs) according to the commodities’ HS code.

4). Trade Data Collection

HS codes have contributed greatly to the unification of customs and trade procedures, reducing costs related to international trade. People do not need to “translate” to read and understand this code.

Various international organizations and governments use this rule as a basis for testing and determining trade policies and tariffs, collecting transportation and trade statistics, as well as economic research and analysis.

5). Confirm Application of Rules of Origin, Enjoy Preferential Tax Rate

In order to implement preferential or differential treatment of tariffs, quantitative restrictions or other trade-related measures, the customs must determine the country of origin of imported goods according to the standards of the rules of origin, and give corresponding customs treatment (e.g. (e.g. tariff reduction and exemption treatment, convenient customs clearance procedures, etc.)

Whether or not import and export commodities can enjoy the preferential tax rate of the agreement of origin does not depend on the name of the commodity.

The commodity classification code of this commodity should be included in the category of preferential agreements, which is the fundamental prerequisite for enjoying preferential tax rates.

6). Manufacturers to Understand the Tax Rate of Goods

The manufacturers in China could know the tax rate of goods according to the HS code or tariff schedule code (HS code is 6 digits worldwide, while tariff schedule code is 10 digits in China).

And the current tax rebate rate for export commodities in China is directly linked to the tariff schedule code, which determines whether the product can be refunded or the different tax rebate rates that may be applicable.

The tax rate and the tax rebate rate will be relevant to the cost control at the manufacturing end, which will finally affect the importers from China.

What is the HS Code of Sanitary Ware?

| Item Name | Material | HS Code |

|---|---|---|

| Porcelain bathroom, kitchen & other sanitary fixtures, e.g. porcelain basin, toilet, urinal, bidet, etc. | Porcelain (Ceramic) | 691010 |

| Pottery bathroom kitchen & other sanitary fixtures (not porcelain), e,.g. pottery basin, toilet, urinal, bidet, etc. | Pottery | 691090 |

| Bathtub, shower tray, and wash basin, of plastics | Acrylic (Plastic) | 392210 |

| Shower Room | Glass, Aluminum, Plastic | 761010 |

| Faucet | Brass / Zinc Alloy | 848190 |

| Shower | Brass | 740182 |

| Bathroom Vanity (Cabinet) | MDF | 940360 |

| Bathroom Vanity (Cabinet) | Stainless Steel / Aluminum | 940320 |

| Bathroom Vanity (Cabinet) | PVC | 940370 |

| Bathroom Accessories, e.g. towel rack, toilet paper holder, soap dish, toilet brush holder, etc. | Brass | 741820 |

| Bathroom Accessories, e.g. towel rack, toilet paper holder, soap dish, toilet brush holder, etc. | Stainless Steel | 732490 |

| Kitchen Sink | Stainless Steel | 732490 |

How to Find Out the Goods HS Code Before Importing?

As a businessman, you might not only import bathroom products from China, but also other construction materials. How could I find out the HS code before importing? Here are some suggestions.

- 1). Search online from your local customs, enter ‘HTS code + product name + country’ (e.g. HTS code ceramic basin UK), it will show the HS Code and maybe relevant tax.

- 2). Ask your shipping agent. When you import from China, you would like to know the overall costs except the quotation from Chinese suppliers, but also sea shipping freight, costs at the destination port of your country, tax when importing, and the delivery cost from the port to your warehouse. Ask your shipping agent by providing the product name, photos, materials, quantity, size, trade terms, usage, and estimate value, they will check the HS code and overall costs accordingly for you.

- 3). Ask your Chinese suppliers. As an experienced industry suppliers, they could know more precisely of the goods and material information, and provide the right HS code.

- 4.) Ask people who works in the same industry or check on the industry association information.

What Will Happen If the HS Code Was Wrong?

Once you declare the HS code wrong to the customs,

- 1). It will affect the time and efficiency of clearing customs at destination port.

- 2). As an importer, you and your shipping agent (or the customs broker) need to explain to the customs department, and let them agree to reclassify the HS code. (You might need to convince the customs that you are lack of sufficient knowledge, and with limited ability, but not mean to deliberate tax evasion, so that the customs department would agree to reclassify the commodity.)

- 3). If your explanation is unacceptable by the customs and they think you are deliberately defrauding taxes (for example, you have kept similar records in the customs before), then your case will have to be transferred to the Anti-Smuggling Bureau. This will be more troublesome. In addition to reclassification, a fine must be paid, which will affect the company’s reputation in the customs and cause trouble for some other customs-related businesses in the future.

Remember, before your sanitary ware orders arrive at the destination port, you need to double confirm with your suppliers and your shipping agents or customs relative staffs, what documents will be needed to clear the customs, and what is the HS code of each item, so that you could avoid the administrative or criminal liability.

1 thought on “What is the HS Code of Sanitary Ware?”

Thank you for sharing this detailed explanation of HS Codes related to sanitary ware. It’s incredibly helpful for anyone involved in international trade, ensuring they understand the importance of correctly classifying goods to avoid customs issues. The breakdown of different materials and their corresponding HS Codes is particularly useful. Your guidance on finding the correct code before importing and the potential consequences of incorrect declarations provides a clear and practical approach. Thanks again for this valuable information.